Introduction

A main feature of coresuite finance cube is the cash flow statement, one of the most important instruments of every CFO. But what is a cash flow? Why is it important? How does it work? How is coresuite cube able to present cash flow. With 2 blog posts, I try to explain it.

- Cash flow with SAP Business One and coresuite cube part 1 (this post)

Theory about cash flow and its 2 methods - Cash flow with SAP Business One and coresuite cube part 2

How does coresuite finance cube apply the theory of part 1

History of cash flow

Before 1910, there were 2 financial statements relevant for CFO’s:

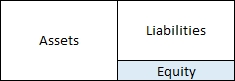

- Balance (the first statement)

This is the oldest statement. The balance is like a picture and shows on a certain moment the difference between between assets and liabilities, which results in equity. The main reason of a balance is to determine the equity.

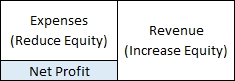

- Income statement (the second statement)

Already the rich Persian king Cyrus asked how his treasure grew. The answer was the extraction of gemstones, successful harvest and more. This was a first kind of an income statement. But it took another 2000 years, until Luca Pacioli described the double-entry accounting in 1494. The income statement is a view on a certain period of time and explains the increase or decrease of capital.

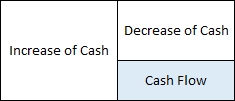

- Cash flow (the third statement)

In the last decades, the economy became more complex: Increased company sizes, international connections or increased competitor pressure are only a few points. The management responsibilities gained in importance. One of the most important innovations was the cash flow statement. The cash flow statement analyzes in a period of time (like income statement) the increase and decrease of cash.

Cash and cash equivalents

To understand, what Increase of Cash or Decrease of Cash means, it is important to understand the term Cash or Cash and cash equivalents. Please refer to the table below.

| Position | Description |

| Cash | This position contains petty cash and assets on financial institution. |

| + Cash equivalents | These positions contain assets which can be quickly converted into cash with a low risk of value fluctuation. Examples could be fixed deposits or market receivables. |

| = Cash and cash equivalents | Both positions above result in cash and cash equivalents. |

Structure of cash flow

It doesn’t matter, if a cash flow is calculated direct or indirect, the structure is always the same:

| Position | Examples Increase | Examples Decrease |

| Cash flow from operating activitiesIncreases and decreases from the operative business. Basically, these information can be derived from the profit loss statement. |

|

|

| Cash flow from investing activitiesIncreases and decreases from the purchase and sales from fixed assets. |

|

|

| Cash flow from financing activitiesIncreases and decreases from changes in finance obligations, paid share capital or profit disctibution. |

|

|

Calculation of cash flow

There are 2 methods to calculate a cash flow or cash drain. Cash drain means a negative cash flow, when a company loses cash during a period of time.

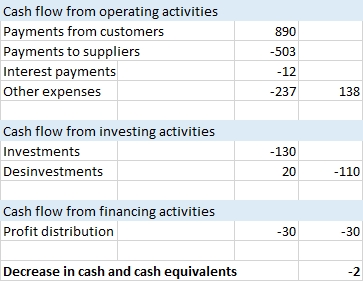

- Direct calculation: The principle of a direct calculation is exactly as described above in the structure of a cash flow

- Indirect calculation: This principle is a transition of a companies profit to the cash flow

Direct calculation

The following example shows a direct cash flow calculation.

Indirect calculation

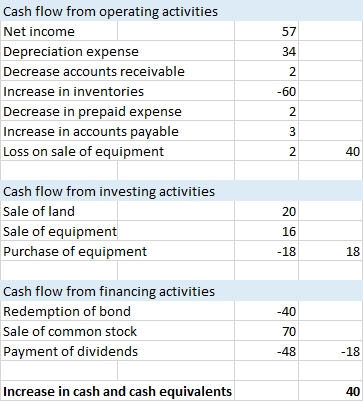

The next example shows an indirect one, which starts from the net income.

Summary

I hope, this blog post helps you to have an overview about the cash flow, what it is and how it works. The next post will show, how coresuite cube is able to present you a complete indirect cash flow calculation from your SAP Business One.

3 Comments

Alex · March 2, 2014 at 14:46

Hi,

Thanks for the SBO learning material. i am looking for SBO9xStudyguide in English.

waiting for your reply.

Peter Andrews · March 12, 2014 at 01:18

Thank you for that succinct post on cash flow. Looking forward to the next one.

Cash flow with SAP Business One and coresuite cube (part 2) | Geri Grenacher · March 18, 2014 at 09:33

[…] flow with SAP Business One and coresuite cube part 1 Theory about cash flow and its 2 […]